Retirement

When Should You Start Investing for Retirement?

February 11, 2021

Understanding Different Types of Credit Cards

February 5, 2021

YCR-Tax Season is Just Around the Corner

February 4, 2021

The Basics About IRAs

February 3, 2021

More Resources & Articles

Bank Accounts

GO2bank Review: The Ultimate Mobile Bank Account

February 2, 2021

GO2bank is the new kid on the block in the online banking world. They have gained traction across the United States and market themselves as “The Ultimate Mobile Bank Account. Simple. Seamless. Smart”, but is it true? Is it as good as ...

Make Money

Start a Business: 8 Steps to Turn Your Idea into a Working Business

October 15, 2020

Have you ever had a business idea that was so groundbreaking, so profound, that you knew it could change your life and impact markets on a local or global scale? We’ve all had those “eureka” moments when it comes to thinking of business ideas. May...

Save Money

How Much Money Should You Save Each Month?

September 17, 2020

Figuring out how much to save every month is an important tool when planning for your future. But how much money you should be saving each month isn’t always simple to figure out. There are rules such as the 50/30/20 income split but is that a goo...

Debt

A Real Solution For High Credit Card Debt

September 11, 2020

This is a paid article Living day to day with huge amounts of debt can seem like carrying the weight of the world on your shoulders. It’s hard to breathe, hard to sleep, and hard to see the light at the end of the tunnel. Countless American ...

Student Loans

Finding The Best Student Loans For Education

September 3, 2020

Student loans can be a complicated burden but for many people getting a student loan is the only way they can pursue a higher education degree. Here we’ll look at education loans and the fastest way you can pay off your loans. The average co...

#Credit Repair Services

Credit Review

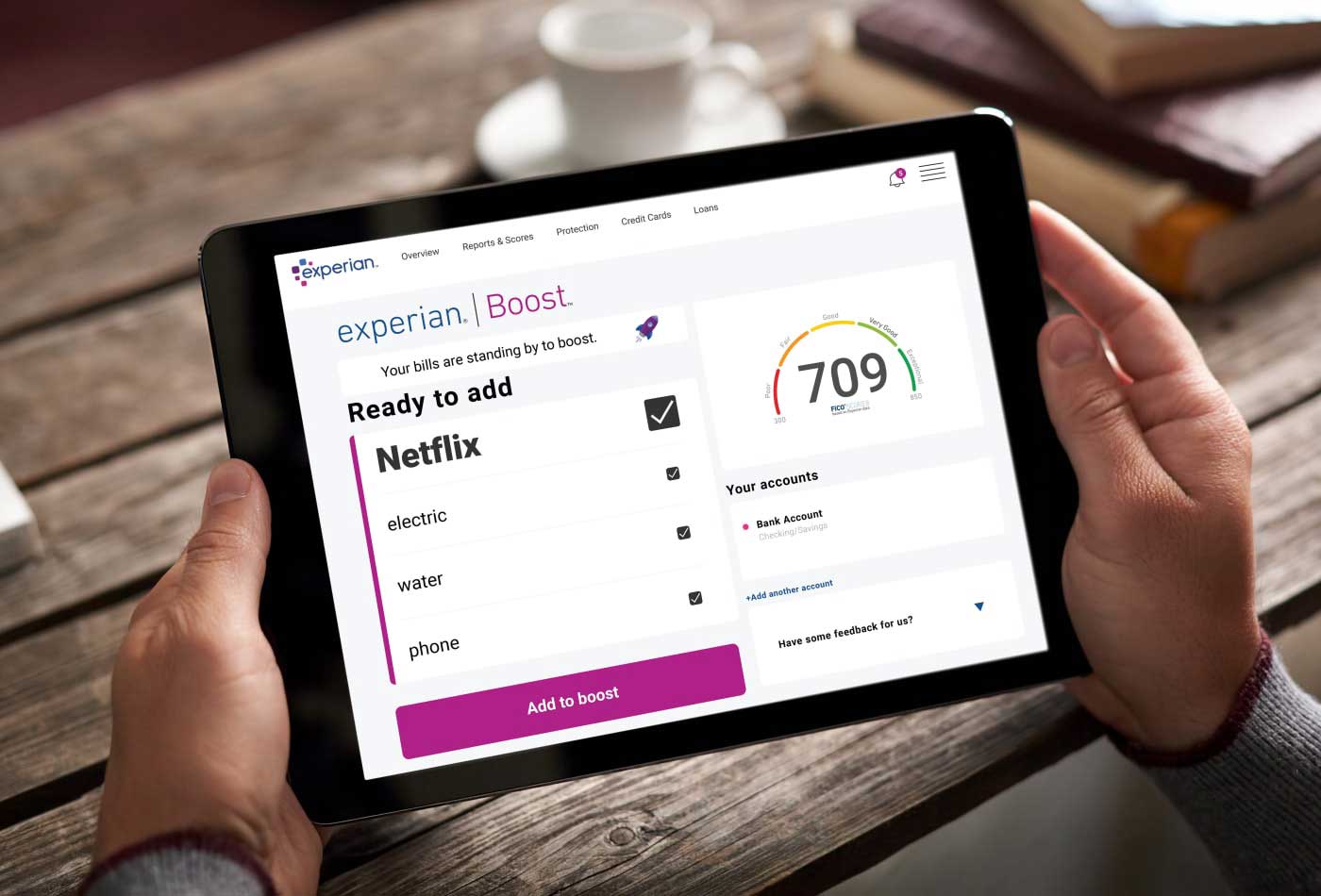

Experian Boost Review

August 5, 2020

Having a good credit score can have major impacts on the way in which you live your life. The problem is that typically improving your score from bad to good and beyond to excellent can take a long time. But through Experian, improving your credit...

Credit Review

Credit Score Review: Experian CreditWorks

August 4, 2020

It’s scary to think that in the past several years some 40+ million Americans have had their identities stolen, which is a staggering 2 out of 5 individuals. Although you probably shouldn’t be losing sleep over this fact it does illust...

Credit Review

Credit Score Review: GoFreeCredit

August 4, 2020

Being on top of your credit score is important in today’s modern economy. There are hundreds of different places to get your credit score, credit monitoring, and other services related to knowing and building your credit. Here we’ll lo...

Credit Review

Credit Score Review: FreeScore360

August 4, 2020

It’s generally a good idea to check and know your credit score. Whether you’re looking for a card to build credit, get a car loan, apply for a mortgage, or even sign an apartment lease; your credit score could be the make or break item...